Rehabbed the Wrong House? A Real-Life South Side Title Tangle

Chicago (August 5, 2025) - Most real estate attorneys would value a survey to research and document where the improvements sit on the Lot. For example, does the home conform to the building set back line? Or do the utilities to the home come with restrictive easements? And do the fences follow the lot lines?

Rarely, but often enough that we make it a regular part of our real estate practice, the house itself is not entirely within the property lines, and we seek to identify possible remedies in the buying and closing process through title insurance special risk coverage.

So when a surveyor communicates back to us, “we noticed a discrepancy with the legal description that was provided,” we should probably stand up and pay attention.

Because what we eventually discovered was something altogether different, and far more complicated.

A Tale of Two Brick Houses

Our seller purchased a home at judicial sale, intending to renovate and flip it. The home was occupied and the name on the mailbox matched the name in the foreclosure suit. Service was obtained, an order of possession granted and the sheriff’s office assisted with a peaceable eviction, and then our seller began a complete renovation of the home. The house he worked on, a red brick single-family residence, was then listed on the MLS, placed under contract, and scheduled to close.

The closing was set for 10:00 AM in our Loop office. Everything appeared to be in order for the closing; the buyer’s loan documents were in the possession of the title company with a lender approved final Closing Disclosure, buyer’s and lender’s funds in our escrow account, and original executed conveyance documents. We were only waiting on the completion of the survey. Field work was to be completed that morning.

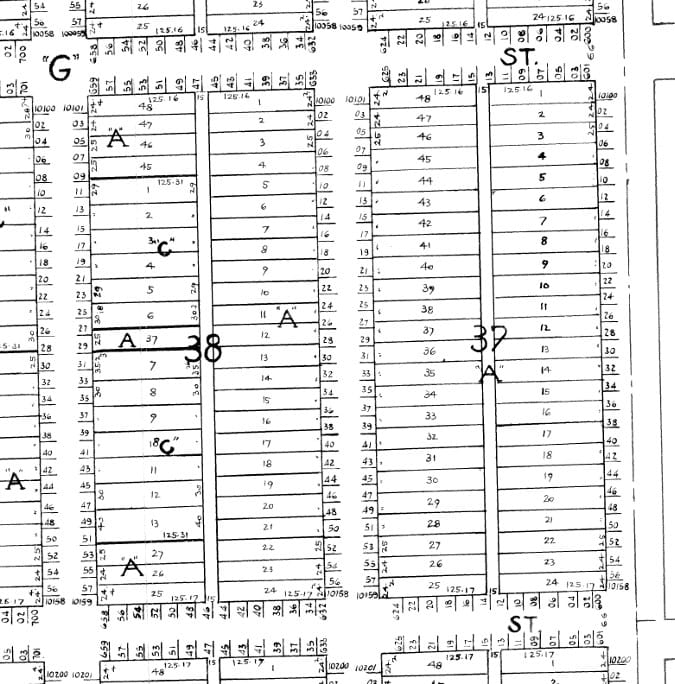

That is when the surveyor mentioned their concern about the legal description, and added this note: "Please be advised that based on available information, field work was completed on parcel ID xx-xx-xxx-007-0000, LOT 36." Effectively announcing to us the survey they would be drafting the morning of the closing was not the property identified in the commitment, but of the neighboring property.

The Discovery

Two neighboring properties, similar in appearance, both brick, 1970s single-family homes, had their ownership and occupancy swapped for what we learned to be nearly 50 years. Our seller had purchased Lot 35 at foreclosure, but all his efforts had gone into Lot 36, which had been occupied since 1977 by a woman named Fannie.

After much discussion and a significant delay in closing, we came to realize the surveyor had an undervalued intimation that guided them to the Lot they chose to measure: the For Sale sign planted in the front yard. Additionally, for us that morning, the seller was in the house (Lot 36) completing a few last-minute items when the surveyor's van pulled up, further helping them identify the Lot they were to survey.

When Neighbors Trade Houses Without Realizing It

It turns out the first indication that something was slightly off was on the very first deeds issued in 1970. The deed to Lot 35 used “10131” as the street address and the deed to Lot 36 used “10133.” In fact, these addresses were swapped. Street numbers increase going south in this part of Chicago and lot numbers in this subdivision increase going north. Fannie’s family, who lived in the yellow brick house at Lot 35, first got wind there might be a mix up when the owners of the red brick house fell on hard times in the 1980s and lost their house in a 1987 foreclosure.

There is a re-recorded deed in the chain from 1995 purportedly trying to remedy the mix-up, but the handwritten note on the re-recorded deed (with no other notations) says “10131 a/k/a 10135.” So that did little to change the fortunes of our neighbors’ ownership and occupancy problem.

So, it would not be surprising that our seller, who thought they bought a red brick house numbered “10131” at a foreclosure auction, would find utility bills, the tax assessee’s address and even a woman living in the residence named Michelle, matching the information they gleaned from the foreclosure suit.

After a long day of research and analysis, our seller knocked on the door to the yellow brick house, finding a woman named Fannie. Fannie's response? "Oh, my father mentioned something like this many, many years ago. I expected this could come up someday."

The Remedy: A Voluntary Exchange of Deeds

The resolution came through a voluntary exchange of deeds. Acting in good faith, and with the facts no longer in dispute, the parties agreed to swap ownership. Fannie conveyed Lot 36 — the fully rehabilitated home under contract, which she legally owned but had never occupied — to our seller. In return, our seller transferred Lot 35 — the yellow brick house he had purchased at a foreclosure auction — to Fannie. This exchange aligned legal title with the long-standing reality of occupancy: neither had legally owned the home in which they actually occupied.

The Tax Tangle

The matter, however, is far from concluded. For years, Fannie had enjoyed the benefit of Homeowner, Senior, and Senior Freeze exemptions on Lot 36, the red brick home she never occupied. Meanwhile, Lot 35, the yellow brick home she has lived in all along, carried a tax burden four times higher, and whose taxes are currently delinquent. This raises multiple concerns. The misapplied exemptions could result in back taxes, penalties, and audits unless Fannie and our seller take the initiative to work with the assessor’s office to explain the error and reestablish the exemptions for the correct property. The delinquency on Lot 35 was generously paid for by our seller. Following the exchange, new exemption applications were submitted ensuring the legal and tax records are fully synchronized.

And what about Title Insurance?

Title insurance is another indispensable consideration. Once the corrective deeds are recorded, Fannie and our seller should receive new title policies for the homes they now properly own. These policies not only provide ongoing protection of ownership rights but also safeguard Fannie’s ability to retain her senior exemptions and seek correction of any tax misapplications that may linger from the historical error.

So How do You Value a Survey?

This unusual case underscores the multifaceted value of a professional survey of the Land. In our sale its purpose extended far beyond verifying setbacks and locating fences; it uncovered a fundamental error that would otherwise have remained hidden. It also illustrates the inherent risks of foreclosure acquisitions, particularly when occupancy and legal title accidentally diverge.

Closing It Right

Thanks to cooperation and thoughtful legal guidance, this transaction moved forward to a successful conclusion. But it could have gone very differently — especially if one party wasn’t cooperative or if the mistake had been buried even deeper and left for someone else to stumble upon in the future.

In real estate, it's not always about what you see, or is it?

!["Mortgage rates hit highest [level] in 16 years."](/content/images/size/w300/2022/10/F75E69F9-6EE7-4C72-AC43-342CA53D8961.jpeg)